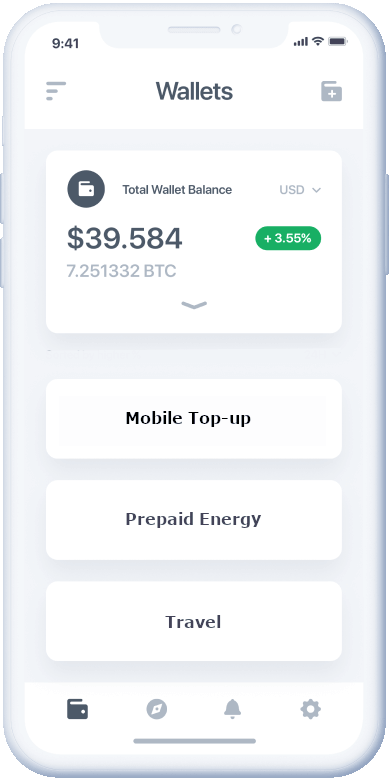

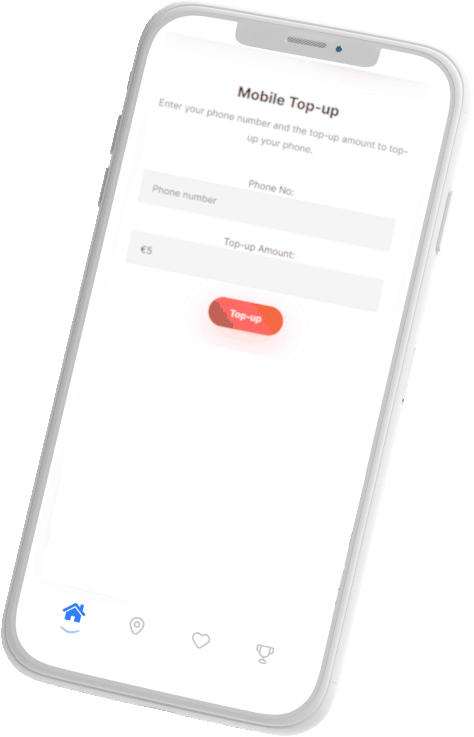

Top-up your prepaid mobile phone straight from your existing bank apps or digital wallets.

Easily add credit to your prepaid electricity or gas meter from your bank apps or digital wallets.

Easily pay for parking, tolls, travel cards, etc. from your bank apps or digital wallets.

Enable your customers to easily and securely pay for services from your apps.

How does it Work?

Once a bank or digital wallet supports Paymware, users can just log in and choose top-up from the menu and initiate the top-up from the list available, i.e. mobile prepaid, prepaid electricity, prepaid gas, etc.

Paymware connects the bank app or wallet to the appropriate Service Provider and initiates the top-up process.

Balance / Credit is applied and the customer is notified in near real-time.

Paymware provides your customers with a new 24-hour digital channel which will increase the ARPU.

Integrating once with Paymware can support payments from multiple banks and digital wallets.

No app to download; your customers can use their existing secure and trusted financial apps. Best-in-class UX.

Paymware uses the bank level anti-fraud controls to eliminate your exposure to fraud and reduce expensive chargebacks.

Paymware uses APIs and input validation techniques to reduce the number of support queries for Service Providers and banks.

Paymware can integrate with your existing APIs to reduce onboarding complexity and time to go live.

Paymware uses bank-level security and business continuity processes in accordance with ISO 27001:2022 and 22301:2019 certifications.

By integrating once with Paymware your apps will be able to support real-time payment for common everyday services.

Paymware will add further payment options, new Service Providers and even entirely new Sectors without need for additional IT Projects

Grow app touches as more services are added in the future.

Keep up with your customers real-time needs for innovative payment solutions and services.

Paymware uses bank-level security and business continuity processes in accordance with ISO 27001:2022 and 22301:2019 certifications.

Paymware will work with both the financial institutions and the service providers to ensure that the customer experience has been optimised to provide the best service available to their customers.

Paymware uses best in class UX approaches gleaned from global digital banking leaders. Paymware has used this to identify key features that will ensure an intuitive and satisfying process for your customers that will reduce key pain points, and importantly support queries, for financial institutions, service providers and their customers.

Contact Us for MoreFor financial institutions, Paymware can operate in low and medium touch scenarios depending on your organisations preferences. Low touch requires minimal IT resources on your side and we do all the heavy lifting. In a medium touch scenario, your app team will work with us to implement the approprite customer journeys to maximize the experience for your customers.

For service providers, Paymware can integrate into your back office systems directly via APIs, back-office systems, or via sFTP. We will work with your teams to ensure the best possible experience for your customers.

Get Started

Loading...